Frequently Asked Questions (FAQs)

Our frequently asked questions are broken up into these topics.

- General information

- Getting to know Funds in Court

- How funds in Court work

- Using funds in Court

- Investments

- Other entitlements

General information

- Why does the Court manage funds on behalf of private individuals under a legal disability, many of whom are minors?

- How long has the Court been managing such funds?

- How does a court decide how much money I should receive as compensation and if funds awarded as compensation should be paid to the Senior Master?

- What happens when a client’s funds are first paid into Court?

- Who comes to the first meeting and why?

- How often can a client meet a Client Services Officer [CSO] or a Client Liaison Officer [CLO]?

- Can a client make contact whenever they want?

- How are decisions made about how clients’ funds are to be used? Will clients’ wishes be considered?

- How does FIC invest clients’ funds?

- What are the investment returns on Common Fund No. 2 [CF-2] and Common Fund No. 3 [CF-3]?

- How often can clients find out what is happening with their money?

- How safe are clients’ funds?

- What is FIC’s Administration Expense Ratio?

- How does FIC’s AER measure against similar organisations?

Why does the Court manage funds on behalf of private individuals under a legal disability, many of whom are minors?

Funds are paid into Court either as a result of an order of the Supreme Court or other courts, or under legislation providing for the receipt of such funds. Most funds paid into Court can only be paid out by Court order. The Judicial Registrar or the Senior Master make such orders.

As well as funds ordered to be paid to the Senior Master by the Supreme Court, funds are paid into Court by other courts (i.e. County Court and Magistrates’ Court) or by the Victims of Crime Assistance Tribunal (VOCAT). This money may be compensation from an accident or injury, from a will or for people under 18 who have lost a parent or have been victims of crime.

Funds are paid into Court by a court order because a person is under a ‘legal disability’. This might be because they:

- have had an accident, injury or illness

- have an intellectual or physical disability (or both)

- are under 18.

See further:

How long has the Court been managing such funds?

Under it parens patriae jurisdiction, the Court has been managing funds for people under a disability for over 150 years.

How does a court decide how much money I should receive as compensation and if funds awarded as compensation should be paid to the Senior Master?

In Victorian courts claims are often brought by a litigation guardian on behalf of a minor, or a person with a disability such as acquired brain injury or dementia. As a person under disability is unable to consent to the compromise (settlement) of their claim against a defendant, such compromise must be approved by the court in order to be valid.

In coming to a decision whether or not to approve a compromise and whether the amount awarded is to be paid into Court, judicial officers (i.e. judges or associate judges) will consider what is in the best interests of the person making the claim. As with any judicial determination, judicial officers will take into account any and all relevant factors in arriving at an independent decision.

See further: Approvals of Compromise

What happens when a client’s funds are first paid into Court?

Upon receipt of funds, a Client Services Officer is allocated responsibility for the day-to-day management of the funds.

Should the client require it, a meeting will be held at FIC to discuss the future administration of your funds.

See further: For Clients

Who comes to the first meeting and why?

The initial meeting is usually attended by the Client Services Manager and the appointed Client Services Officer.

The client may be accompanied by a family member, carer, friend, administrator or legal representative. FIC is committed to supported decision, so wants to make sure that all information about the client and their wishes and needs is conveyed to us. We therefore welcome any person that can assist in providing that information and assisting the client in making a supported decision.

How often can a client meet a Client Services Officer [CSO] or a Client Liaison Officer [CLO]?

Depending on the matter the client wishes to discuss, the client will meet with their CSO or a CLO as often as is reasonably required. A CLO will meet a client in the client’s home or wherever is convenient. FIC does not place a limit on meetings or visits.

Can a client make contact whenever they want?

Yes. FIC has dedicated and trained reception staff who will put the client in contact with their Client Services Officer. FIC’s reception staff can also answer many routine questions. FIC does not have an automated call centre.

How are decisions made about how clients’ funds are to be used? Will clients’ wishes be considered?

FIC makes every effort to ensure that clients’ wishes in how funds are to be used are paramount.

It is for this reason that every client has a Client Services Officer who will assist and support the client and their carer/family in making an application to use the funds. The Client Services Officer’s role is to facilitate supported decision making for the client.

Approval of a client’s request for the use of funds is given by the Senior Master or Judicial Registrar. This is because funds can only be paid out by a court order and only the Senior Master or Judicial Registrar can make such an order.

However, in doing so, the Senior Master and Judicial Registrar will always give prime consideration to a client’s will and preference.

See further: How to access your funds

How does FIC invest clients’ funds?

Apart from the day to day management of the funds, FIC endeavours to grow clients’ funds (subject to prevailing economic and investment conditions) to cover current and future needs.

FIC has its own Investment Services section that oversees the investment of clients’ funds.

See further: How we manage your funds

What are the investment returns on Common Fund No. 2 [CF-2] and Common Fund No. 3 [CF-3]?

FIC has two common funds. CF-2 is a fund that invests in interest bearing investments. CF-3 is a fund that invests in Australian shares. The performance of both funds is measured against accepted industry benchmarks. FIC publishes all relevant information on the returns of its Common Funds.

See further: Investment Information in the Publications section of this website.

How often can clients find out what is happening with their money?

FIC sends six-monthly statements to all clients (and/or their nominated representative). Clients may contact their Client Services Officer at any time to obtain information about their funds.

FIC also publishes a wide range of information on the funds in:

How safe are clients’ funds?

FIC has a very conservative investment objective:

“To prudently manage the assets within the framework of the Supreme Court Act so as to maximise the long term returns to beneficiaries [clients] without exposing them to undue risk”.

The Information Guide about the risks of investment can be found below:

Information Guide-Investment Risk

How much does it cost to look after clients’ funds?

FIC does not charge direct fees nor does it make a profit from clients’ investments.

FIC only recovers the cost of administration expenses. The cost of doing so is set out every year in the FIC Financial Report and a special Information Guide.

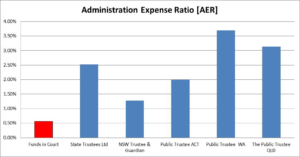

What is FIC’s Administration Expense Ratio?

FIC’s AER for the 2022-23 financial year is 0.64%.

See further: Cost Recovery

How does FIC’s AER measure against similar organisations?

AER = total expenditure excluding depreciation for the financial year

total assets under management and trusteeship at the end of the financial year

Note: Information to complete the above graph has been extracted from each organisation’s 2018 Annual report.

Getting to know Funds in Court

Use these links to find the answers to frequently asked questions about FIC.

What does ‘funds in Court’ mean?

‘Funds in Court’ is money that has been paid through the Supreme Court, the County Court, the Magistrates’ Court or the Victims of Crime Assistance Tribunal (VOCAT).

This money is usually compensation, from a will or a payment to someone who is under 18 and has lost a parent or been a victim of crime.

Who is a ‘client’?

A client of the Court is someone who has their funds held by the Supreme Court of Victoria and administered by the Senior Master.

Funds in Court administers money for over 7,000 clients.

Who is the Senior Master?

The Senior Master is an Associate Judge of the Supreme Court of Victoria. The Senior Master is responsible for all funds held in Court.

How funds in Court work

Use these links to find the answers to frequently asked questions about how funds in Court work. This information applies to people who are clients of the Court.

Why does the Senior Master look after my money?

The Senior Master looks after your money because a judge or magistrate has decided that you need support managing your money.

Why can I not look after my money?

This is because you are under what it known as a ‘legal disability’. It might be because you have an intellectual or physical disability (or both) or you are under 18.

What do I have to do to get control of my money?

If you have an intellectual or physical disability, you need to show that you have capacity to manage your own affairs. This means going through an assessment by a neuropsychologist or occupational therapist.

If you are turning 18 you can apply to have your funds paid out to you. See When you turn 18.

Why can’t I be paid out if it is my money?

The Senior Master might decide FIC needs to continue administering your funds. This is usually because your disability or personal circumstances might make it difficult for you to manage the money in the long term. Of course, this in no way limits your ability to use your money. FIC, and your Client Services Officer, will always support you and your family/carers in making decisions about the use of your funds.

How much money do I have?

Everyone has a different amount held in Court. You will receive a statement twice a year which will tell you how much money you have. You can also phone FIC at any time and ask your Client Services Officer to let you know.

Using funds in Court

Use these links to find the answers to frequently asked questions about how funds in Court can be accessed and used. This information applies to people who are clients of the Court.

- How can I get my funds to buy something?

- What sort of items can I use my funds in Court money for?

- Can I buy a car?

- Can I buy a house?

- How do I make application for payment out of funds in Court?

- Who decides if I can use my funds in Court?

- What do I do if the Senior Master does not approve my application?

How can I get my funds to buy something?

You can access your funds – it is your money. You need to apply to the Senior Master. Talk to your Client Services Officer and they can support you with making a decision in how your funds are used.

What sort of items can I use my funds in Court money for?

You can apply to use your funds for all sorts of things. You might want to buy some clothes or shoes, or go on a trip. You can apply to use your funds for furniture or things for your home. If you are studying you may be able to cover the costs of your course, uniform or pay for a computer.

Some people have used their funds in Court to buy a house or a car.

Find out more in What your funds can be used for.

Can I buy a car?

Some clients are able to buy a car using their funds in Court. It always depends on your own circumstances. You need to show that you can afford all the costs involved with owning a car. You also need to show that you (or someone who will be driving you) has a current drivers licence and is able to be insured.

Find out more in Buying a car.

Can I buy a house?

Some clients are able to buy a house using their funds in Court. It always depends on your own circumstances. You need to show that you can afford all the costs involved with owning a house, like insurance, rates and maintaining the property. Find out more in Buying a house.

You might also need to modify your home to suit your disability. Find out more in Modifying a house.

How do I make application for payment out of funds in Court?

You can make an application by either:

-

-

- phoning FIC and talking to your Client Services Officer

- sending an email or letter

-

Find out more in How to access your funds, or Contact us to speak to your Client Services Officer.

Who decides if I can use my funds in Court?

Approval of your request for the use of funds is given by the Senior Master or Judicial Registrar. This is because funds can only be paid out by a court order and only the Senior Master or Judicial Registrar can make such an order.

However, in doing so, the Senior Master and Judicial Registrar will always give prime consideration to your will and preference.

What do I do if the Senior Master does not approve my application?

If your application is not approved, you may be able to make some changes and re-submit it to the Senior Master. There might also be another option or solution for you to follow. You should talk to your Client Services Officer about what you can do.

Investments

Use these links to find the answers to frequently asked questions about key terms used in the administration of funds in Court.

- What is CF-2?

- What is CF-3?

- Why are there withdrawals listed on my CF-2 account statement?

- Why do my statements talk about ‘Frank’?

- Can you do my personal tax return?

What is CF-2?

CF-2 stands for Common Fund No. 2. This is a type of account that clients have their money in.

CF-2 is similar to a bank account but it is controlled by the Senior Master. Interest accrues daily and is paid yearly. Find out more in Common funds.

What is CF-3?

CF-3 stands for Common Fund No. 3. This fund is similar to a share portfolio. The Senior Master invests primarily in ‘blue-chip’ companies which, generally, are low-risk but return solid profits.

Client’ money is combined in CF-3 to purchase these shares. Find out more in Common funds.

Why are there withdrawals listed on my CF-2 account statement?

Twice a year, you will receive a statement from FIC which lists every deposit or withdrawal for your accounts. You receive a separate statement for both CF-2 and CF-3.

Some withdrawals from your CF-2 might be deposits into your CF-3 account. Otherwise, the statements list every amount that you spend from your funds in Court. If you receive maintenance payments, these will also be listed on your statement as a withdrawal.

Find out more in Understanding your statements.

Can you do my personal tax return?

FIC does not do personal tax returns for clients.

You should go to a tax accountant for help if you need to lodge a personal tax return. Your accountant can call FIC to discuss any tax-related matters.

FIC does do a ‘trust tax return’ for every client each year. You will receive a copy of your trust tax return in the mail. You should wait until you have this before doing your personal tax return, as you may have earned interest on your funds that needs to be declared.

Other entitlements

Use these links to find the answers to frequently asked questions about other payments that clients may be entitled to, and how having funds in Court can affect them.

- Why does having funds in Court affect my Centrelink payment when I don’t have control of my money?

- I received compensation from the Victims of Crime Assistance Tribunal (VOCAT) – can I ask for more money?

Why does having funds in Court affect my Centrelink payment when I don’t have control of my money?

If you use, or get benefit from, your funds in Court, then Centrelink consider it as income for the income and assets tests.

This is the same as if you had a private trust fund. It is the law under the Social Security Act 1991.

I received compensation from the Victims of Crime Assistance Tribunal (VOCAT) – can I ask for more money?

If you have been paid money (an ‘award’), you are able to apply for more assistance for things like counselling, medical expenses or some payments. This is known as a ‘variation of award’.

If you think this would help you, please contact VOCAT. If you’re not sure you can talk to your Client Services Officer first.